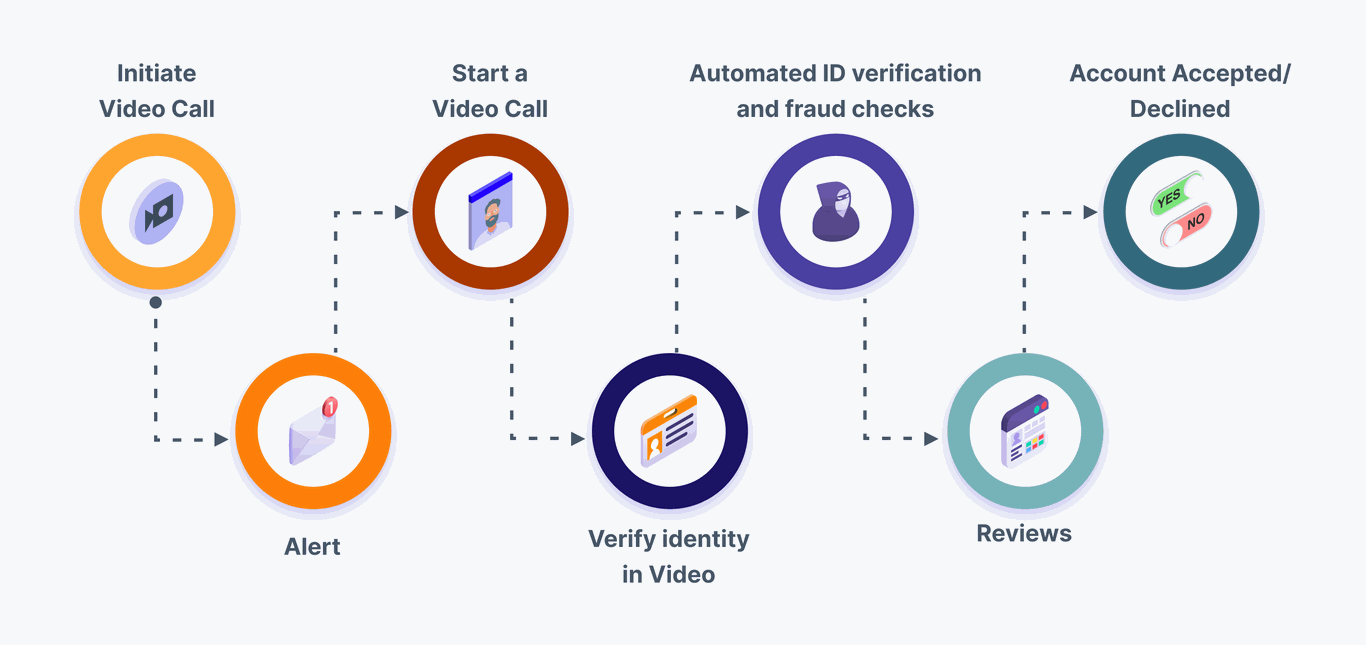

HOW VIDEO KYC CALL WORKS?

A Service Agent/Operator assists customers through a video call to finish the secure and hassle-free authentication process

EMPOWERED WITH INTELLIGENT AI

Digibank’s Video KYC Call helps businesses keep pace with banks and financial institutions, to provide the rapid service delivery that customers expect, while protecting them from fraudsters or cyber attacks. Millions of identities are automatically authenticated with maximum accuracy through using AI.

YOUR CUSTOMER IS THE TOP PRIORITY

Video KYC Call can be used as a secured authentication method to unlock high-risk banking services. Customers can immediately connect with your agents or schedule an appointment

We provide fortified security with our comprehensive features that are built into this new method

to fight against digital fraud:

An unparalleled level of protection

through end-to-end encryption, high-resolution capabilities, and continuous signal monitoring

Authentic person identification

easily reached by enabling real-time audio and visual interactions with customers, and backed by automated document and face recognition scans

Beyond mere verification

by automatically detect and track suspicious behaviors to pinpoint potential threats, and ultimately prevent security breaches before their occur

USE CASE

Transaction Value Upgrading

Offer a secure and efficient solution for customers to verify their identity remotely, facilitating a seamless process that enables high transaction values while maintaining stringent security measures and regulatory compliance

Loan/Credit Issuance

Minimize time spent on paperwork, automate the approval of loan or credit processes for legitimate borrowers, and prevent financial fraud risks with the help of AI and biometric checks

Compliance Monitoring

Aid businesses in meeting regional and international regulations and standards, such as KYC, AML, and GDPR. This can assist in minimizing the risk of regulatory fines and reputational damages