DETECT AND ANALYZE SUSPICIOUS ACTIVITIES

To reap the benefits of technological advancements, banks face heightened risks that can impact financial stability. Digital fraud risk management is one of the five key risks for banks, according to Basel Committee on Banking Supervision.

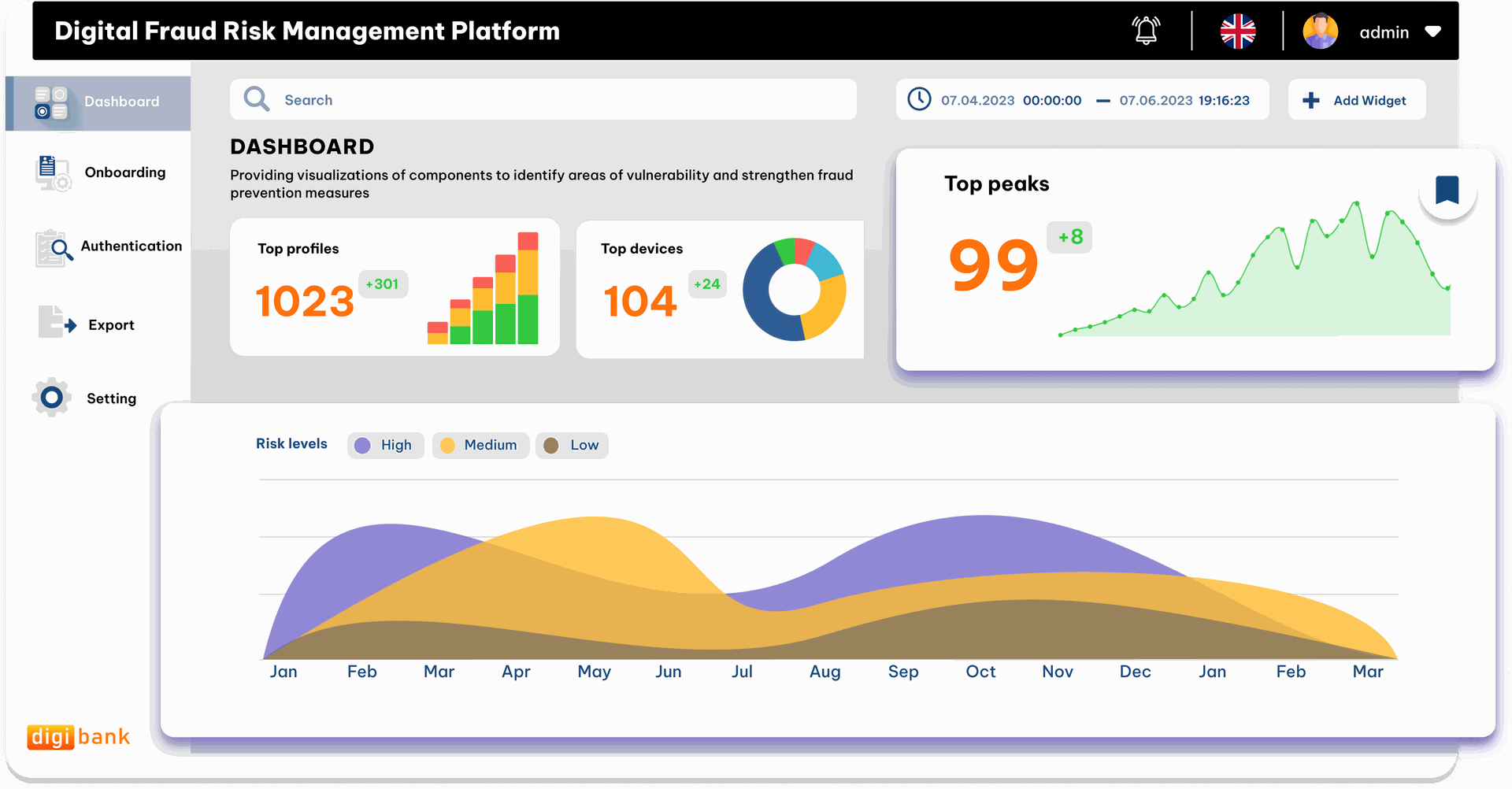

Digital Fraud Risk Management Platform contains advanced capabilities and data intelligence to provide real-time assessment and validation of users' identity, identity documents, devices, and endpoint security for post-onboarding processes.

ADVANCED FRAUD SCORING SYSTEM

Modernize your post-onboarding audit process with confident risk mitigation

ADVANCED FRAUD SCORING SYSTEM

Modernize your post-onboarding audit process with confident risk mitigation

Audit powered by AI analytics

Promptly detect high-risk cases with AI-powered Fraud Scoring algorithm to help businesses audit a large volume of user data in real-time, based on Behavioral analysis, Fraud pattern detection, Duplicate check, Graphic manipulation detection, and more.

Multi-parameter audit configurations

Present, sort, and handle user data using different data parameters to detect and resolve threats unique to your business

Quality Assurance

Based on Fraud Scoring evaluation and fraud risks management processes, the suspected cases will be flagged for human inspection, which improves fraud detection rates by up to 90%

WHY CHOOSE DIGIBANK?

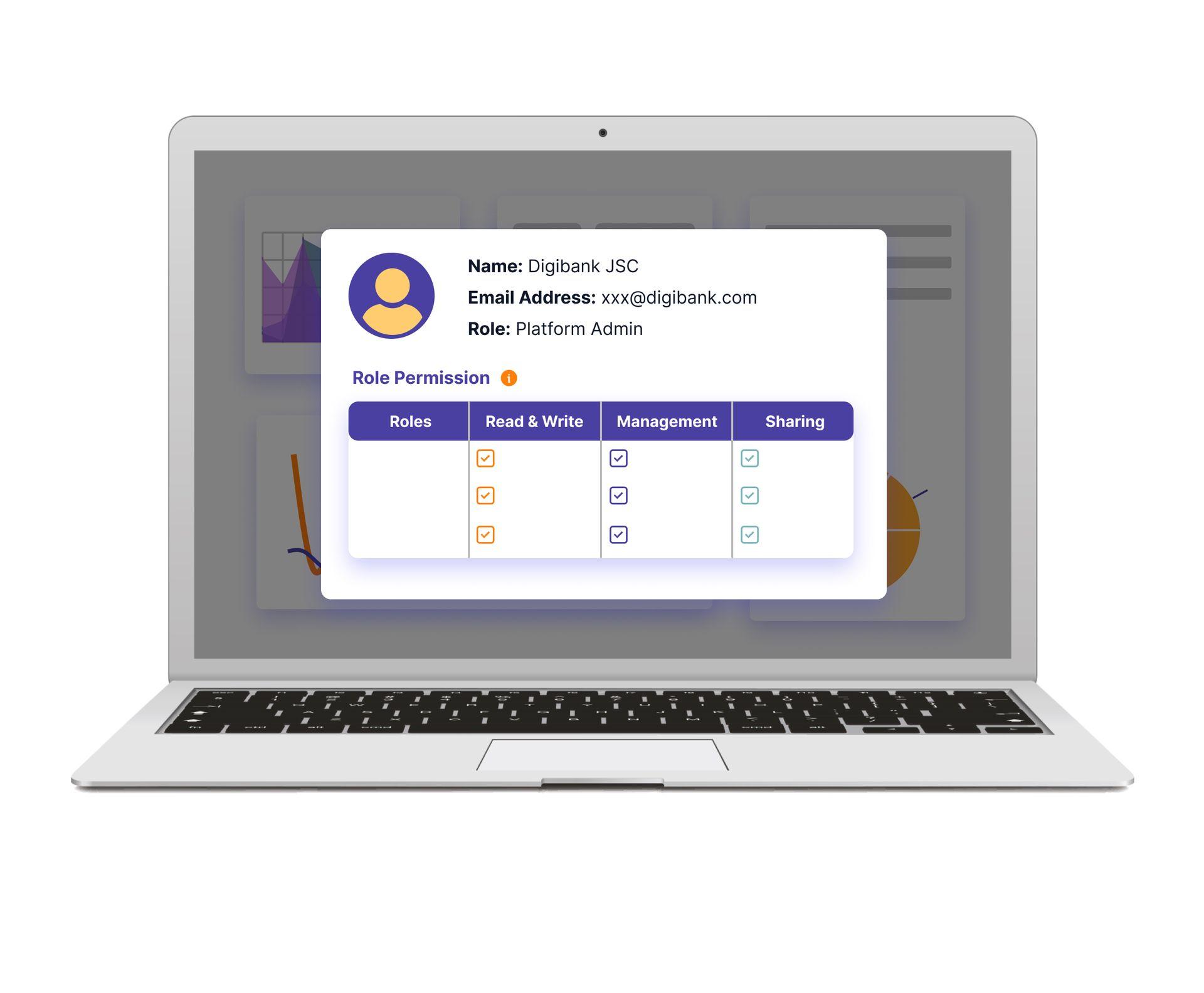

Plug-and-play

No complex integration required, your human inspection can immediately use the functions after being granted access

Real-time fraud data enrichment

Provide a convenient platform for monitoring end-users behaviors.

Drives down false positive results

Protect your business immediately by preventing 99.9% of fraudulent attempts. Eliminate false positives while pinpointing high-risk cases from the data of millions of customers for manual audits

Legal Compliance

Comply with regulations, international standards, and supervisory guidelines for the banking sector in digital fraud management such as AML, CTF, RM in eBanking, CPMI-IOSCO Principles for financial market infrastructures, etc

USE CASES

Customer Due Diligence (CDD) and Enhanced CDD support

Develop risk profiles for end-users based on their behavior, and activity history and adjust risk thresholds and monitoring parameters based on individual customer risk profiles

Data Enrichment

Organize and enrich the current dataset to provide a more complete picture and improve the accuracy of identifying suspicious transactions